-

October 9, 2024

-

Comment: 0

ULI, OCEN and ONDC Demystified: Part II

In Part I of this blog, we explored the foundational elements of ULI, ONDC, and OCEN, laying the groundwork to understand these frameworks. Now, in Part II, we delve deeper into their synergies, examining the services they provide, the user base they serve, and the challenges their users encounter. These platforms represent more than just digital tools; they are pillars of a new financial ecosystem aimed at democratizing access to credit, commerce, and data.

Synergies: A Shared Mission for Financial Inclusion

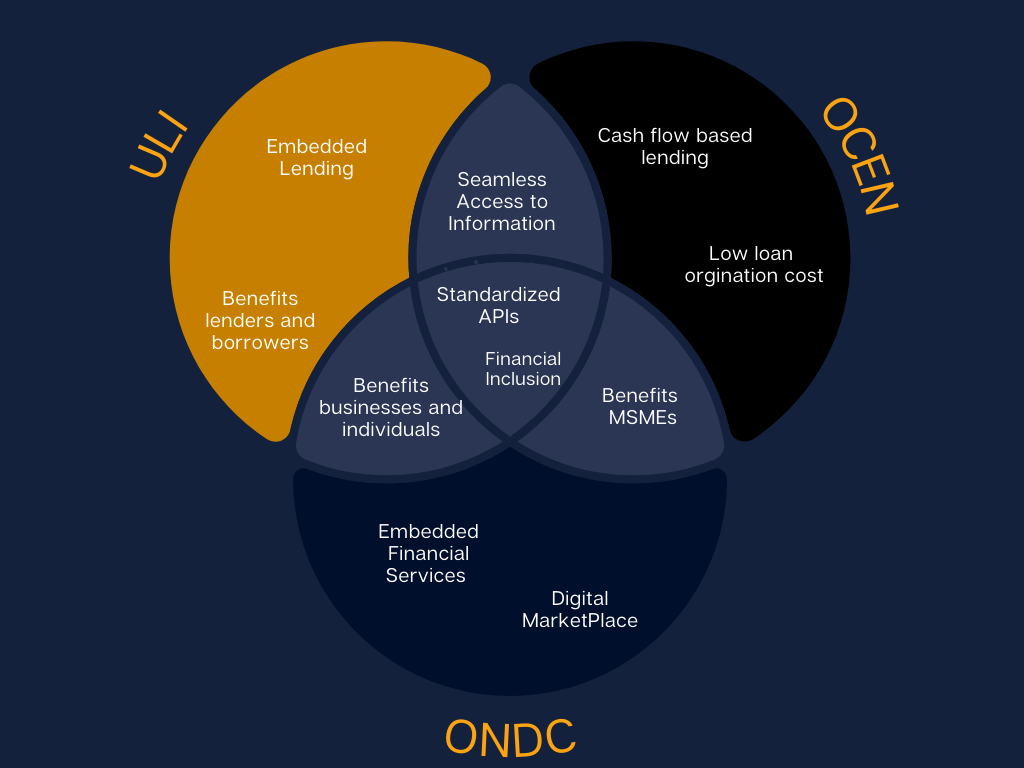

At their core, ULI, ONDC, and OCEN share a common mission: to promote financial inclusion and make access to credit more seamless and democratic. While each platform addresses different facets—ULI focuses on lending data, OCEN on enabling credit, and ONDC on digital commerce—their services frequently overlap, creating powerful synergies that make the lending and commerce experience more accessible, efficient, and equitable.

Each platform brings its strengths to the table, but the commonality lies in their ability to break down traditional barriers to financial access. They aim to build a robust, interconnected landscape where data and services can flow freely. For instance, ULI centralizes lending data, while OCEN acts as the bridge between borrowers and lenders, and ONDC decentralizes e-commerce, integrating financial services for both buyers and sellers. Together, these platforms cater to underserved segments, such as MSMEs (Micro, Small, and Medium Enterprises) and rural borrowers, making financial access a reality rather than a privilege.

A Common Framework: Standardized APIs and Data Integration

A significant point of convergence among these platforms is their use of standardized APIs (Application Programming Interfaces), which allow for efficient communication across different systems. By employing these APIs, ULI, OCEN, and ONDC are able to integrate diverse data sources, whether it’s land records for ULI, e-commerce transaction data for OCEN, or sales data for ONDC. This standardization simplifies the exchange of information, making it easier for lenders to assess borrowers’ creditworthiness while providing quicker access to loans.

Another key overlap is data aggregation. ULI, OCEN, and ONDC all collect and process data from various sources to form comprehensive financial profiles. ULI aggregates data like land ownership records and financial histories, helping lenders make informed credit decisions. OCEN pulls in data from non-lending platforms, providing lenders with a more accurate assessment of MSMEs’ creditworthiness. ONDC, although primarily focused on digital commerce, uses transaction histories and sales data to offer credit options to sellers in real-time. This integration of data across platforms allows for smarter, data-driven decisions, thereby extending credit to a wider, often underserved, population.

Democratizing Access to Credit Across Multiple Channels

The shared mission of democratizing access to credit is another significant overlap. ULI simplifies formal credit access by offering verified borrower information, streamlining loan approvals. OCEN bridges the gap between lenders and borrowers by empowering non-lending platforms—like e-commerce or ride-sharing services—to act as gateways for credit distribution. ONDC, while focusing on creating an open digital commerce network, embeds lending services into the e-commerce flow, allowing sellers and buyers to access credit seamlessly. These platforms collectively aim to make credit accessible to individuals and businesses who would otherwise be overlooked by traditional banks.

MSMEs and Rural Borrowers: A Common User Base

One of the most important intersections between ULI, OCEN, and ONDC is their focus on MSMEs and rural borrowers. MSMEs, the backbone of India’s economy, often struggle to access formal credit due to a lack of traditional collateral or a comprehensive credit history. ULI accelerates credit assessment for MSMEs by providing verified, aggregated data, while OCEN allows these businesses to leverage their transaction histories and revenue streams to secure loans. ONDC, by offering a decentralized platform for digital commerce, gives MSMEs the ability to reach new markets while also offering embedded financial services, such as working capital loans.

Rural borrowers also benefit from these platforms. ULI provides lenders with access to digital land records, which simplifies the process of using land as collateral for loans. OCEN taps into alternative data sources to assess the creditworthiness of rural businesses that may not have conventional financial histories. ONDC’s inclusion of rural sellers helps to democratize access to credit by enabling them to access real-time loan options based on their transaction history. In short, these platforms are playing a pivotal role in bridging the financial inclusion gap between urban and rural regions.